When completing your BAS you must report taxable sales and the GST in their price at. Additionally states also levy Value Added Tax VAT.

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

The highest tax slab under the GST is 28 while the fuels such as petrol and diesel are taxed at more than 100 currently.

. All HS Codes or HSN Codes for petrol with GST Rates HSN Code 1201 GITANKS Products Include. Analysis of GST on petrol Diesel Nowadays petrol. Smart Simple and 100 free filing Personalised Tax Filing experience Accurate Calculations guaranteed Helpful tips for self filing Free live chat facility Disclaimer.

Currently both central and state governments levy taxes on petrol and diesel ie. GST on Fuel The rise in global crude prices after August 2020 has led to an immediate rise in fuel prices across the country which has provoked a demand for including petrol and diesel under GST. Our business is registered for gst.

However to introduce petrol and diesel within the GST is a political call to action and it must be according to the decisions taken by both the centre and states. 20 rows HSN Code GST Rate for Coal Petroleum other fossil fuels - Chapter 27 File with us to win your taxes Ready to File. For petrol and diesel to be brought under GST the rates would have.

On your BAS you disclose either the GST-inclusive or the GST-exclusive. MV expenses - petrol which tax code should I use. The Taxes on petrol and diesel in the form of Excise Duty levied by the Central govt and VAT by States account for almost 40 to 50 of the total cost price of petroleum products in India.

Yes this is true. What happens if GST implement on petrol diesel GST was introduced on 1st April 2017 at that time petroleum products were kept out of the preview of GST us 92. Gi Metal Water Storage Tank HSN Code 2705 Coal gas water gas producer gas lean gas and similar gases excluding petroleum gases and other gaseous hydrocarbons HSN Code 2709 Petroleum oils and oils obtained from bituminous minerals crude HSN Code 2710.

The excise duty on petrol is approximately 1948 per litre and 1533 per. Is it GST or N-T. The procedure to find HS Code with tax rate is.

The tax structure for petrol and diesel is likely to be a peak tax rate of 28 per cent plus states levying some amount of local sales tax or. GST HS Code and rates for Diesel n petrol Serach GST hs code and tax rate Showing Result for Diesel n petrol Find GST HSN Codes with Tax Rates Here you can search HS Code of all products we have curated list of available HS code with GST website. Petrol and diesel cant be expected to be taxed belowmore than 28 per cent in the current scenario as it is major revenue part of Government.

The latest GST Council Meeting was held on 17 September 2020 wherein the inclusion of petrol and diesel under the GST regime was discussed. The Goods and Services tax GST was introduced in India from July 1 2017 which subsumed all indirect taxes levied by the central and state governments. Central State government are taking Excise Vat Tax respectively on petrol Diesel.

At 28 per cent GST the petrol and diesel will be sold at cheaper than the current rate for one litre of the fuel. Excise duty and VAT or value added tax. The GST slabs are 5 12 18 and 28 which is how the Government would not get the tax above a fraction of what they get now.

Subscribe to RSS Feed. What happens if GST implement on petrol diesel GST was introduced on 1st April 2017 at that time petroleum products were kept out of the preview of GST us 9 2. However petroleum products such as petrol diesel jet fuel and natural gas were kept out of the purview of GST in order to preserve the revenue acquired by the states.

The procedure to find HS Code with tax rate is very simple. G1 Total sales 1A GST on sales. GST Rates HSN Codes for Fuel wood Wood Charcoal.

Should amount claimed in BAS be excluding or including gst for tax purposes. 0 Kudos 3 REPLIES 3. So the central govt and State Govts gets lot of revenue through Excise Duty and VATState Sales Tax respectively.

The Centre applied a total of INR 2790 per litre of excise duty on the petrol while INR 2180 per litre on the diesel fuel. GST HS Code and rates for petrol Serach GST hs code and tax rate Showing Result for petrol Find GST HSN Codes with Tax Rates Here you can search HS Code of all products we have curated list of available HS code with GST website. However the Finance Minister of India Nirmala Sitharaman announced later that the council has decided that the fossil fuels cannot be brought under the ambit of the indirect tax at this point in time.

Taxable sales are sales where GST is payable. The GST regime provides five different taxation rates of 0 5 12 18 and 28 per cent. The Parliament of India passed the GST or the Goods and Services Tax Act on 29th March 2017 and it came into effect on 1st July 2017.

For instance if 28 per cent GST is levied upon the dealers base price of Rs 3070 the consumer will have to shell out Rs 3930 for a litre of petrol which is Rs 31 less than the existing price. 0 Kudos 2 REPLIES 2. However there may be variations due to Governments latest.

Wood in the rough Split poles Particle board Board of Coiur Jute fibre All rates codes are best to our latest information. Assuming that fuel is charged even under the highest tax slab of 28 per cent the prices of petroleum products will fall sharply. Ronatbas Ultimate Partner 4553 Posts.

Is GST claimablereportable on BAS. Central State government are taking Excise Vat Tax respectively. I just like to know myob tax code for Fuel Tax Credit.

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

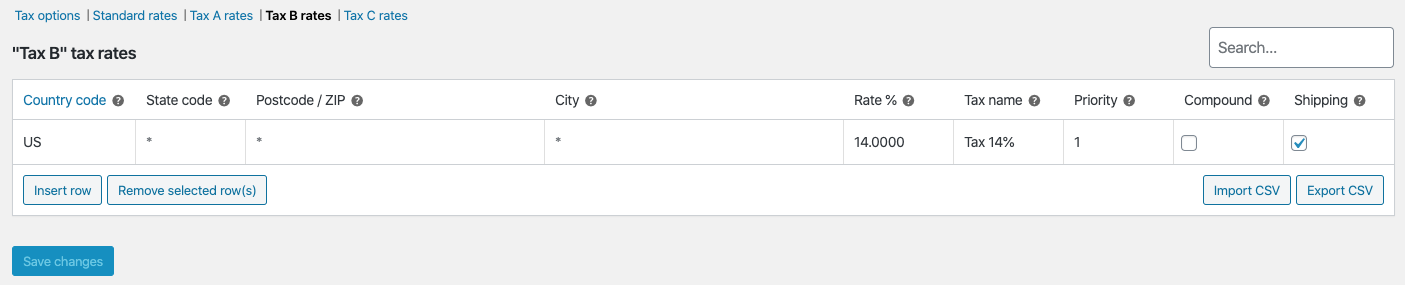

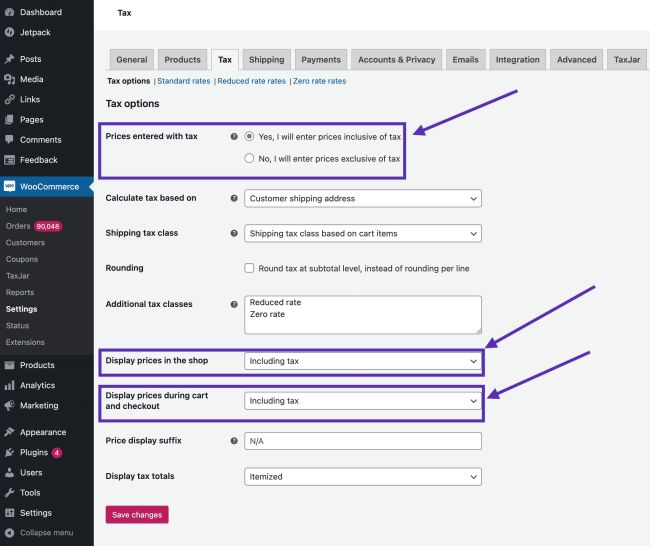

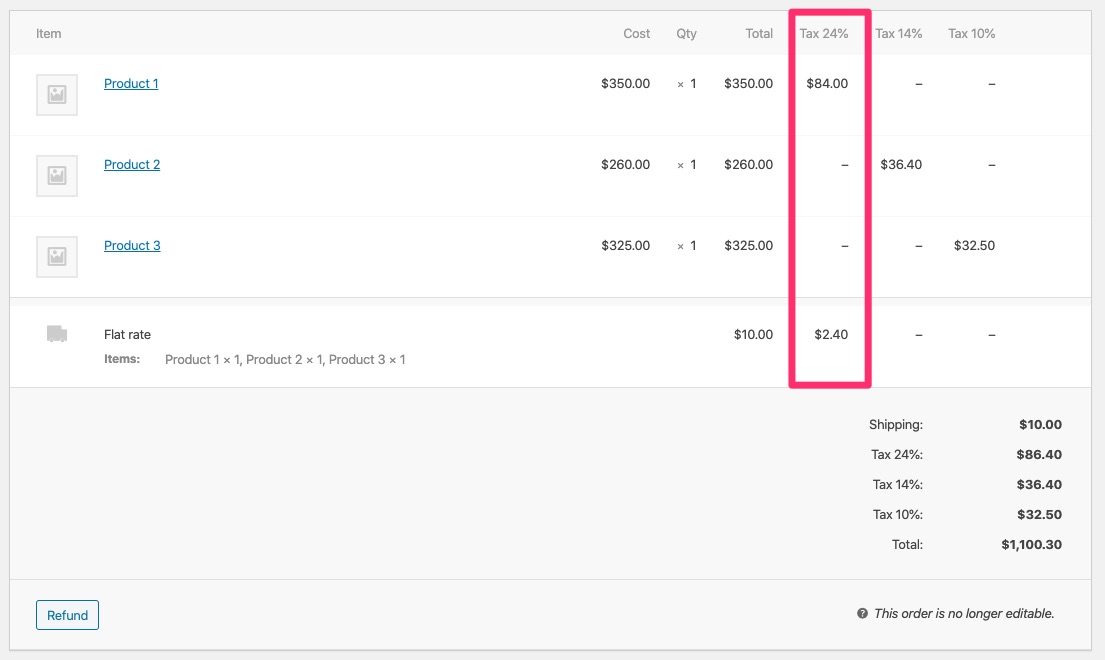

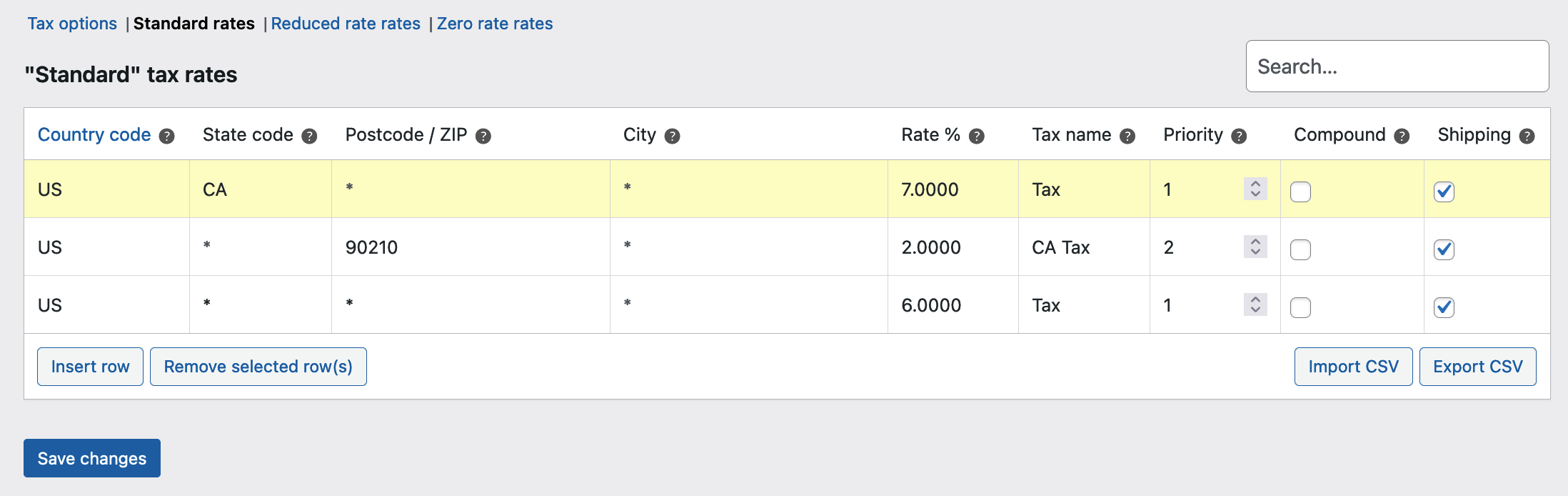

Setting Up Taxes In Woocommerce Woocommerce

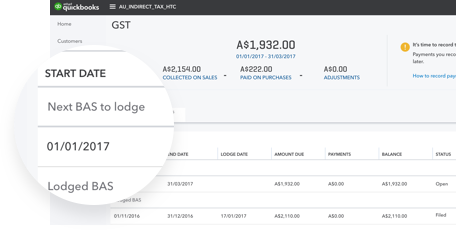

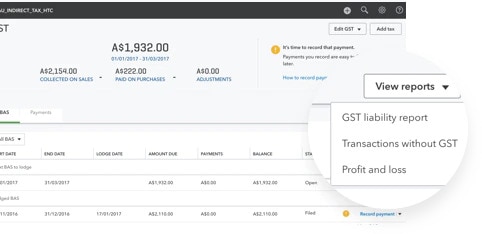

Setting Up Gst In Quickbooks Online Quickbooks Australia

Service Vat Invoice Template Invoice Template Invoice Template Word Invoice Sample

Setting Up Taxes In Woocommerce Woocommerce

If Petrol And Diesel Are Brought Under Gst They Ll Have To Be Taxed At More Than 100 Mint

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Setting Up Taxes In Woocommerce Woocommerce

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Setting Up Taxes In Woocommerce Woocommerce

Hope The Rising Sun On Makar Sankranti Fills Your Life With Abundant Joy Prosperity Happiness An Printer Consumables Printer Joy

Gst At 5 Years India S Historic Tax Reform Is Out Of Fuel Mint

Fuel To Gst Centre State Relations May Emerge As A Rallying Point For Oppn Business Standard News

The Use Of Tax Codes When Entering Transactions Exalt

Setting Up Taxes In Woocommerce Woocommerce

Setting Up Gst In Quickbooks Online Quickbooks Australia